Region’s technology savvy population drives the digital economy, resulting in sustained internet infrastructure market growth

The strategically located South-east Asian (SEA) region is home to a technology savvy population of 650 million people [1]. SEA with its geographical advantage is a vital cog in global merchandise trade and manufacturing.

Annual trade valued at US$5.3 trillion, passes through the sea lanes of SEA and an estimated 15 million bpd (barrels per day) of oil is transported via the strategic Malacca Straits [2]. As the global economy becomes more digitalized, the region’s importance has increased further as it transitions from being a merchandise trade center to becoming one of Asia’s major digital hubs.

The local market is also evolving. Powered by changes in consumer behavior, the SEA’s Internet economy has been growing at an unprecedented pace hitting US$100 billion in 2019, tripling in size over the past four years. By 2025, the Internet economy is expected to grow to US$300 billion [3].

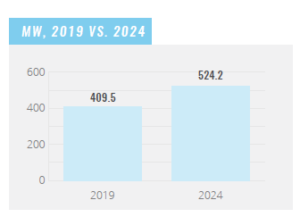

SEA’s booming digital economy and strategic location has attracted leading global technology companies like Google, Amazon, Microsoft and Alibaba Cloud all of whom have either set up state-of-the-art Internet infrastructure in the region [4] or have announced plans to do so in the near future. As a result, SEA will have the fastest growth of colocation data centers with the market expanding at a 13 per cent compounded annual growth rate (CAGR) between 2019 and 2024, according to research by Cushman & Wakefield [5].

A large part of the surge in data center growth will be driven by the adoption of IoT (Internet of Things) solutions as companies adopt Industry 4.0 technologies [6]. IoT devices, especially in industrial settings, dramatically increase the number of connected devices which generate large amounts of data. This data is stored and analyzed in data centers to generate actionable intelligence. Manufacturing, oil and gas, and healthcare sectors are some of the major adopters of IoT in the region. As data centers consume a significant amount of energy, many companies operating in the region are opting for new innovative designs and builds of eco-friendly data centers that are more sustainable and energy efficient [7].

Singapore

As SEA’s hub, Singapore is the largest data center market in the region. Recognized as one of world’s pre-eminent entrepôts, Singapore has always been at the forefront of international trade and commerce. With data being the currency of the new digital economy, it is little wonder the Republic has evolved to become one of the most mature data center locations globally. It is seen as one of Asia’s leading market in terms of data center business operations, ahead of Hong Kong, South Korea and Japan [8].

Multimedia content providers and cloud companies are driving strong demand for data center storage and networking in Singapore. There are a growing number of younger consumers who access high levels of data daily to watch movies, upload photos and videos, play games and make cashless payments. This is attracting interest in colocation activities with various international players looking to set up data center operators in the region to support this growing demand.

Singapore also accounts for the largest supply of Asia Pacific data centers in a single location [9], nearly all major hosting and cloud providers globally have built a presence in Singapore. The growth of the Singapore Data Center market is forecasted to exceed 25% over the five-year period, 2019 – 2024.

Indonesia

The fast-growing Indonesian internet infrastructure market is the next major driver for SEA’s data center market. With more than 170 million internet users in the country, the Indonesian government has prioritized the digital economy as an important sector for economic growth [10].

With a growing middle class, which some estimates believe accounts for more than 50 per cent of the total population, Indonesia has developed into an e-commerce hotbed in SEA. Market estimates reckon that the country’s e-commerce market was worth US$21 billion in gross market value (GMV) terms in 2019. McKinsey expects Indonesia’s e-commerce industry will increase almost four-fold, to be worth US$40 billion by 2022 [11]. As a result, the industry is seeing a lot of investment with established as well as new players shoring up their internet infrastructure in the country.

The Indonesian data center market is expected to grow at a CAGR of around 11 per cent during the period 2019-2025 [12]. According to another report [13], Indonesia added more than 20 million new social media users during 2018–2019 and out of these, more than 10 million are active mobile social media users. Around 95 per cent of mobile users watch online videos, and over 60 per cent of the population now performs banking services via smartphones, thereby increasing the demand for data center facilities in the country. Indonesia’s digital economy which was at over US$30 billion in 2019 and this is expected to grow to US$150 billion by 2025.

Amazon Web Services (AWS) has announced that it will invest US$951 million in the country over the next 10 years [14]. Earlier this year, Google confirmed that it is looking to open its first data center in Jakarta over the next twelve months [15]. Microsoft has also expressed interest in investing in a large data center in Indonesia [16].

Cloud computing giants such as Alibaba Cloud and Google Cloud Platform (GCP) have already or are in the process of establishing their cloud platforms in existing data centers in Indonesia and they seek to fast track their growth [17].

Malaysia, the Philippines & Thailand

The data center market in Malaysia has recently seen strong growth and this is likely to continue over the next few years, according to a report by Research and Markets [18]. The report notes that there has been significant new data center builds and additions to existing capacity as new providers have entered the important SEA market.

Among the other major countries in SEA, the Philippines has the most room for growth of its Internet infrastructure [19], including data centers. The Internet economy makes up 2.1 per cent of the country’s GDP currently, and is expected to hit 5.3 per cent by 2025. The Philippines is experiencing a growth surge in the online media sector, which has recorded a 42 per cent annualized growth rate since 2015. With 69 million users, the Philippines has the second highest number of internet users [20] in SEA, after Indonesia.

Thailand’s data center market has also entered a rapid growth phase due to digital transformation initiatives implemented by the government and increasing data center adoption by small, medium, and large enterprises. The government of Thailand is focusing on enhancing telecommunications and network infrastructure of the country to support hyperscale data centers and is looking for partnership with international data center vendors in this regard [21].

With its headquarters located in Singapore, Princeton Digital Group (PDG) is well positioned to take advantage of internet infrastructure growth in SEA. In 2019, PDG acquired 100% ownership of an existing data center – DCSG (previously known as IO Data Center) and also a 70% ownership of XL Axiata’s data center portfolio in Indonesia. Through a joint venture with XL Axiata, PDG’s portfolio of five data centers across Indonesia will support its strategic expansion in the local market. PDG has further committed US$100 million of growth capital to service the needs of hyperscalers, corporation and telecoms companies in Indonesia.

With a strong presence in Singapore and Indonesia, PDG is strategically positioned to expand in the near future to other growth markets across Southeast Asia.