China has a large and fast-growing data center market, driven by data center operators like Princeton Digital Group complementing the needs of the Government’s “New Infrastructure” strategy to develop more facilities.

The “New Infrastructure” initiative was introduced in early 2020, promoting data center developments, like Princeton Digital Group’s three current and three upcoming facilities, to enable China’s digital future where 710 million citizens are online.

“Online businesses have changed the lives of over one billion people, introducing new ways of life such as digital payment, online education, streaming media, e-sports,” said Zhang Yonghai, Princeton Digital Group’s Managing Director for China.

With China’s “Internet Plus” strategy encouraging businesses to digitally transform, 70% of the population now use e-commerce services, increasing demand for more data centers to keep the world’s second largest economy online.

“With the continued development of new generation AI, 5G, industrial internet, the Internet of Things and autonomous vehicles, there will only be greater demand for higher standard data center resources,” added Mr. Zhang, who has more than 28 years of experience in the IDC industry.

Cloud computing giants and large internet companies like Alibaba, Tencent, ByteDance, Pinduoduo and more are also bringing large demand for data center developments and hyperscale facilities, stimulating another wave of fast growth for the Chinese data center market.

As a result, China has more than 360 data centers, almost 200 providers, and is expected to grow by 3% annually until 2024.

The scale of these data centers is also growing exponentially to meet the growing data capacity demands, from 8MW being the mainstream a few years ago, to 40MW in 2020. The smallest approved Shanghai project in 2020 being a capacity of 24MW, while the largest facilities can be bigger than 100MW, as local customers often choose large-scale customised procurement projects.

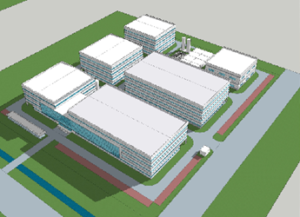

This relatively mature infrastructure, scale and rapid growth in the Chinese data center market is key to the stable development of Princeton Digital Group’s business. PDG already has mature data center assets in large hotspots, including Beijing, Xi’an and Guangzhou as well as a 42MW flagship data center in Shanghai.

“Guided by the Yangtze River Delta integration policies and trends, we are strategically building data centers in Shanghai and its surrounding areas with the goal of creating a new highland of cloud computing and big data analytics,” said Mr. Zhang.

Princeton Digital Group is also developing two new campus projects in Nanjing and Nantong located in Jiangsu province. Their Nanjing facility will be a 41KW data center spanning more than 35,000 square metres, with construction expected to begin in the fourth quarter of this year. The Nantong project is also expected to begin construction later this year, and will have a first phase capacity of 26MW upon completion in late 2022.

Princeton Digital Group strategically selected these two cities, as they are emerging new metros that have been influenced by the “New Infrastructure” policies. Nanjing is the capital of Jiangsu Province and an important transportation and communications hub, while Nantong is closely connected to Shanghai where tech giants like Tencent are located and a new generation of IT is expected to exceed a GDP of US$143 billion in 2020.

Facing the challenges of China’s rapid data center expansion

While China’s rapidly developing data center market brings lucrative opportunities, changes and challenges also arise, including higher customer requirements and standards in design and construction, changes in supply chain, strict PUE regulations and facing fierce competition.

With its manufacturing advantages and highly reliable water and electricity supply, China has a complete industrial chain of manufacturing, installation, and after-sale services to supply data center construction and hardware equipment.

But the country’s data center market has its own unique supply chain ecosystem and high entry barrier where water and electricity are provided by state-controlled enterprises, for which data center operators must apply for the capacity with these designated companies.

“Each of our projects is managed by a full team of business development professionals specialized in policies and regulations of the local governments, including energy experts with excellent resources and understanding on how to obtain the relevant permits and approvals,” said Mr. Zhang, who previously worked for HP China as their General Manager for their data center business in China.

Recently, these supply chains have also started to change to offer custom-manufacture for cloud computing customers, offering more manageable lead time and pricing. To constantly adapt to these changes, Princeton Digital Group partners with both global and local suppliers.

“Backed by deep-pocketed Warburg-Pincus, all current projects by Princeton Digital Group in China are developed on their own land and have acquired all the necessary permits for energy, environmental assessment and power resources to ensure a smooth development process,” added Mr. Zhang.

Unlike other countries in Asia where electricity supplies are less reliable, the challenge in China is meeting strict PUE requirements where data centers must meet a 1.3-1.4 PUE.

“This is particularly challenging to achieve in some economically developed cities in the south of China where the climate is warmer. And as data center scales become larger in China, bigger challenges are imposed on design processes, project and operation management,” said Zhao Yanfei, Princeton Digital Group’s VP of Engineering, who has 15 years of experience in the real estate and IDC sectors in China.

To overcome this challenge, Princeton Digital Group’s facilities are controlled at a PUE of 1.3-1.4 using leading energy and cooling technologies like high voltage direct currents, indirect evaporative cooling and natural cooling technologies.

Princeton Digital Group also leverages the vast experience and cultural knowledge of their in-country team. Princeton Digital Group is able to build fast and aggressively throughout Asia with strong data center industry names like Mr. Zhang, who was responsible for Pioneer Universe Group’s entire data center business in China, and Mr. Zhao, who oversaw the build of all Baidu’s hyperscale data centers across China.

As a pan-Asian operator, Princeton Digital Group is also able to consolidate their industry knowledge, strategic alliances and resources from multiple countries within the Group to support foreign customers interested in entering the Chinese market as well as customers in China looking to explore other markets in Asia Pacific.

“China-based hyperscalers and emerging internet companies are expanding beyond the border and especially into the APAC region at an unprecedented speed. But their growth plans are nonetheless bottlenecked in various markets due to differences in culture, regulation and practises,” added Mr. Zhang.

Princeton Digital Group actively looks for opportunities to serve hyperscalers and collaborate with customers and partners to create multiple channels of communications and resource sharing throughout Asia, including China, Singapore and Indonesia.

As published by W.Media.